ADP payroll is a comprehensive payroll processing and human capital management solution designed to streamline HR tasks and reduce administrative burdens for businesses of all sizes. This in-depth guide explores the key features, benefits, and considerations surrounding ADP payroll systems, providing a clear understanding of how it can benefit your organization. We delve into crucial aspects such as its functionality, cost-effectiveness, integration capabilities, and overall impact on HR efficiency. By the end, you’ll have a solid grasp of whether ADP payroll is the right choice for your business needs.

Introduction

Managing payroll can be a time-consuming and complex process, filled with potential pitfalls like calculation errors, compliance issues, and administrative headaches. ADP, a global leader in human capital management, offers a suite of payroll solutions designed to alleviate these pressures. This comprehensive guide explores the various aspects of the ADP payroll system, helping you determine if it’s the ideal solution to streamline your payroll processes and improve your overall HR efficiency. We’ll unpack the features, benefits, and considerations to empower you to make an informed decision.

Frequently Asked Questions (FAQ)

- Q: What types of businesses use ADP payroll?

A: ADP payroll caters to businesses of all sizes, from small startups to large enterprises, across diverse industries. The system offers scalable solutions to meet the specific needs of each client.

- Q: How much does ADP payroll cost?

A: ADP payroll pricing varies depending on the chosen package, the number of employees, and the specific features required. It’s best to contact ADP directly for a customized quote tailored to your business needs. They offer various plans and add-ons to accommodate differing budgets and requirements.

- Q: How secure is ADP’s payroll data?

A: ADP employs robust security measures to protect payroll data, complying with industry best practices and relevant regulations. They invest heavily in data encryption, access control, and regular security audits to ensure the confidentiality and integrity of your sensitive information.

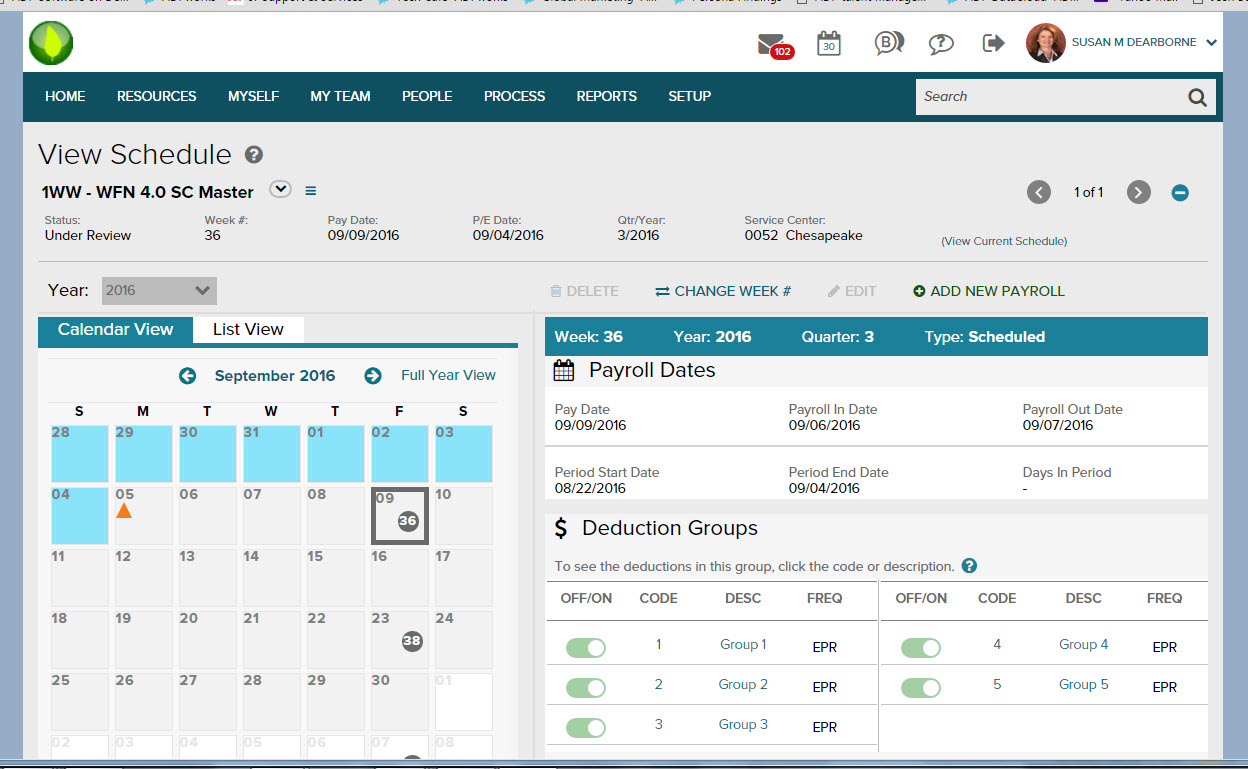

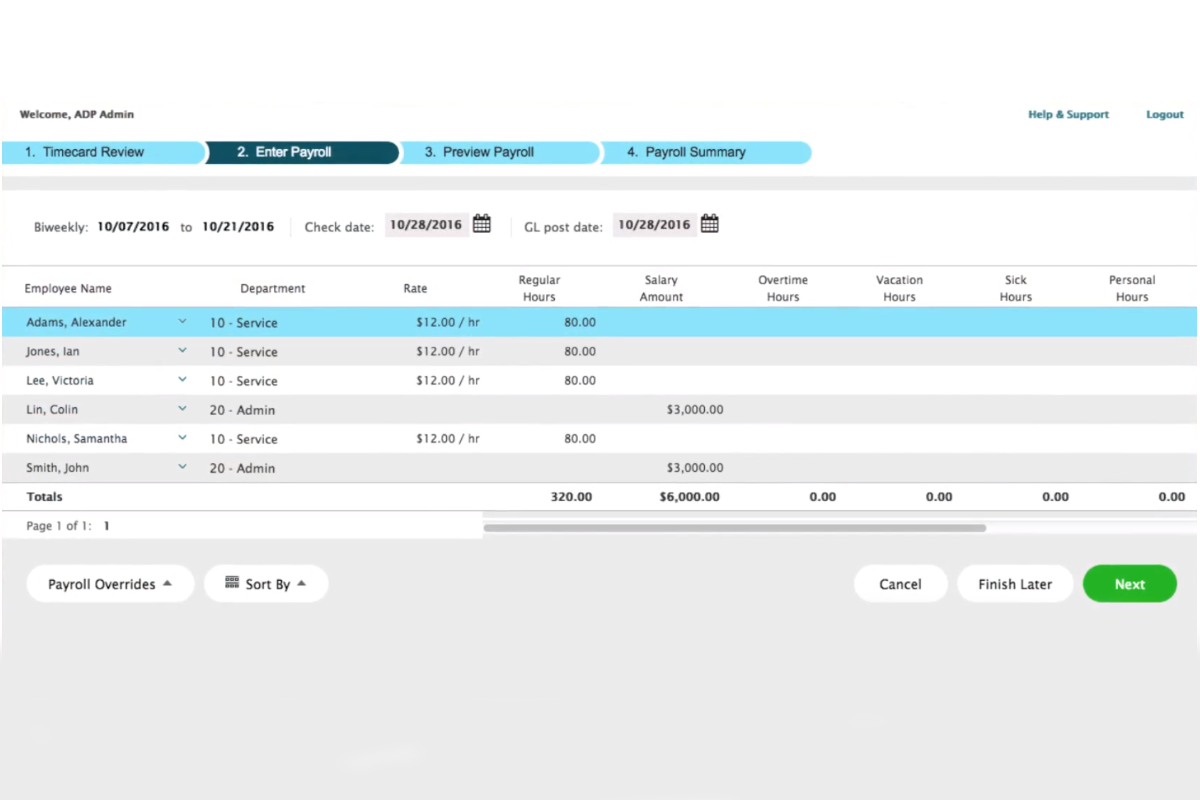

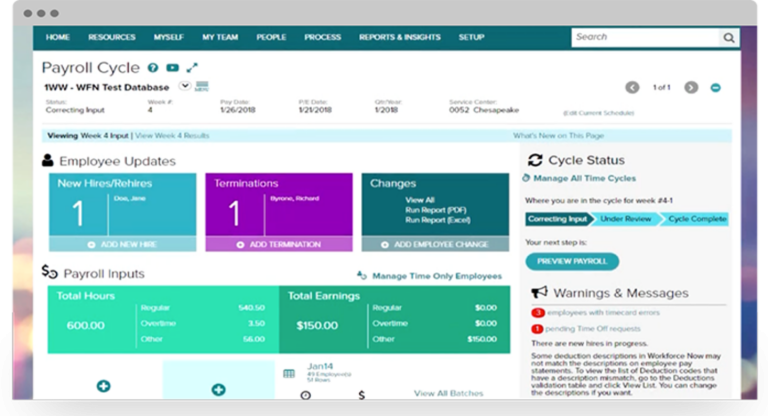

Payroll Processing and Compliance

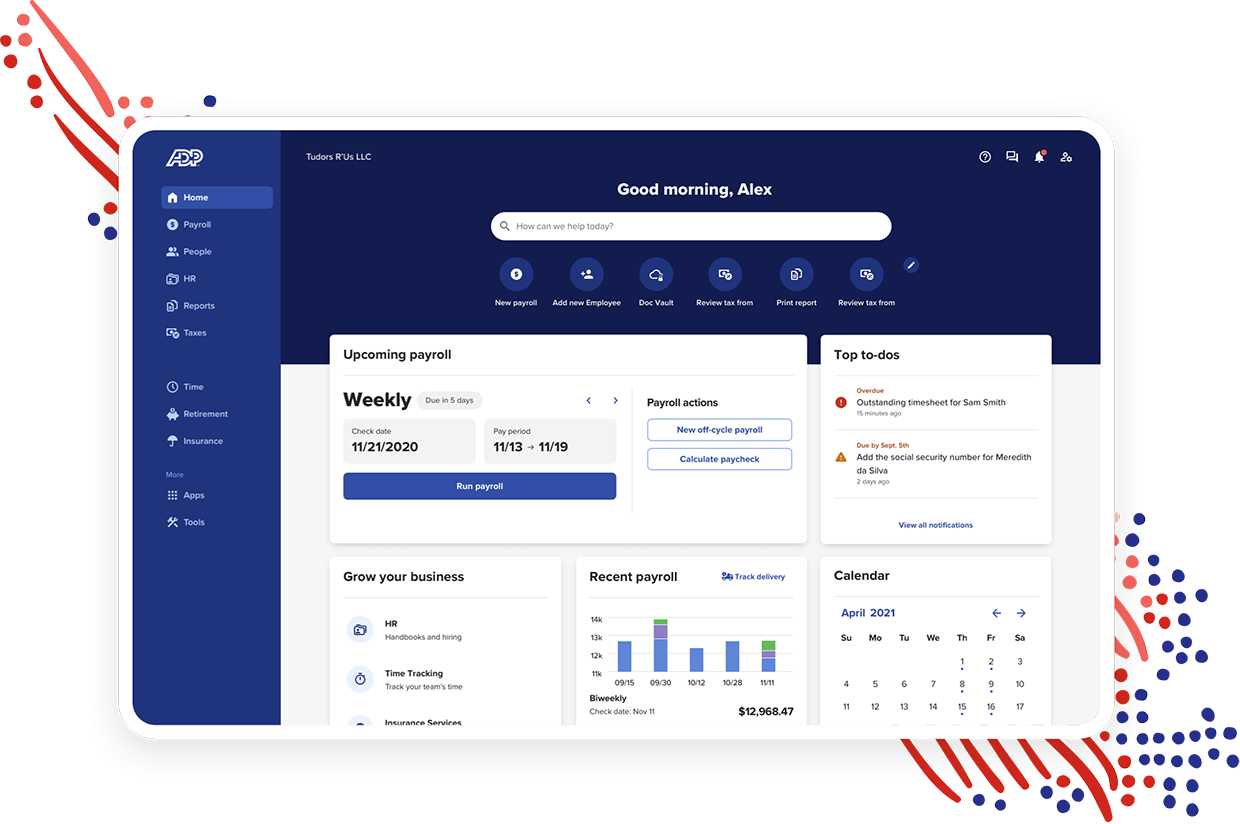

ADP’s payroll processing capabilities are designed for accuracy and efficiency. The system automates many manual tasks, minimizing the risk of human error and freeing up HR staff for more strategic initiatives. ADP ensures compliance with ever-changing federal, state, and local regulations, reducing the risk of costly penalties.

- Automation: ADP automates time-consuming tasks like tax calculations, deductions, and direct deposit, significantly reducing processing time and improving accuracy.

- Compliance: The system automatically updates itself to reflect the latest tax laws and regulations, eliminating the need for manual updates and minimizing compliance risks.

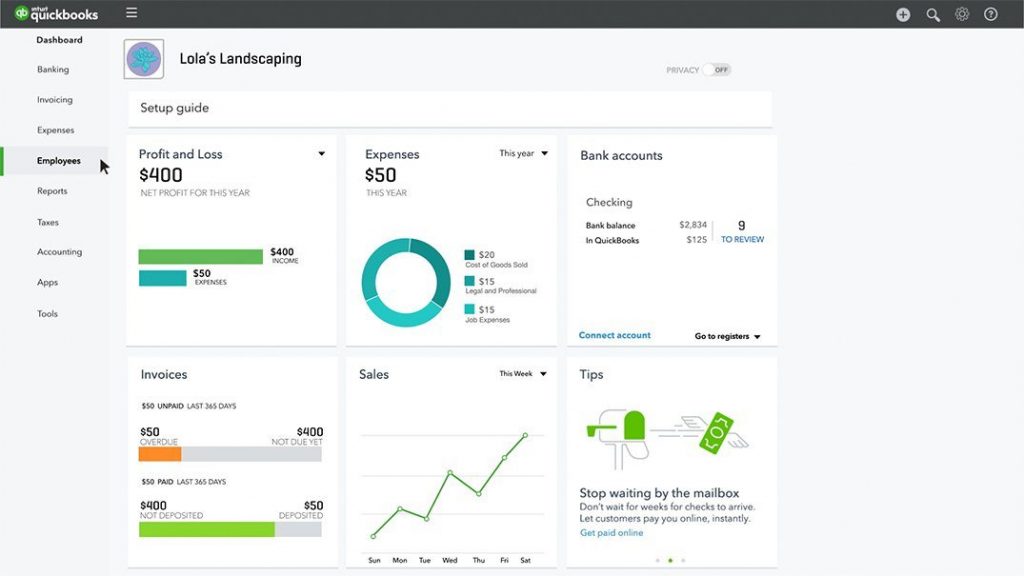

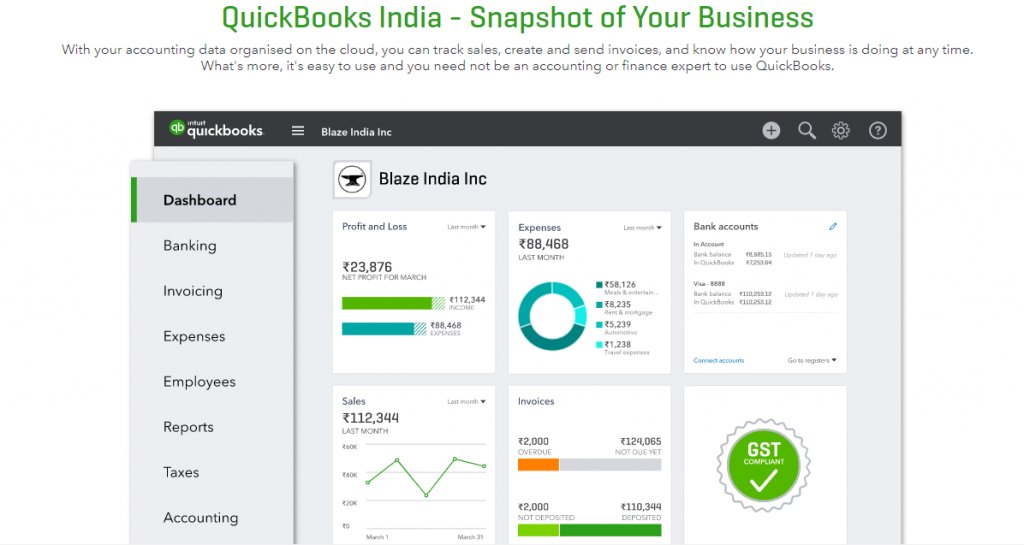

- Integration: ADP payroll seamlessly integrates with other HR systems, streamlining workflows and improving data accuracy across different departments.

- Reporting: ADP provides comprehensive reporting tools to track payroll expenses, analyze labor costs, and generate necessary compliance reports.

- Accuracy: The system minimizes the chance of errors, reducing the time and resources spent correcting mistakes. This ensures employees receive accurate and timely payments.

- Self-Service Portal: Employees can access their pay stubs, W-2s, and other payroll-related information through a secure online portal.

Time and Attendance Tracking

Effective time and attendance tracking is crucial for accurate payroll processing. ADP offers various time and attendance solutions that integrate seamlessly with their payroll system. This ensures that your payroll data is always current and accurate.

- Integration with Payroll: Time and attendance data feeds directly into the payroll system, eliminating manual data entry and reducing errors.

- Real-Time Data: Managers can access real-time data on employee hours worked, simplifying scheduling and providing better insights into labor costs.

- Employee Self-Service: Employees can clock in and out, view their time sheets, and submit requests for time off through a user-friendly interface.

- Mobile Access: Many ADP solutions offer mobile access, allowing employees to track their time from anywhere.

- Overtime Calculations: The system automatically calculates overtime pay, ensuring compliance with labor laws.

- Reporting & Analytics: Detailed reports provide insights into employee attendance, overtime hours, and other key metrics.

Tax Management and Reporting

Navigating the complexities of payroll taxes is a critical aspect of payroll processing. ADP simplifies this process through automated tax calculations, filings, and reporting.

- Automated Tax Calculations: The system automatically calculates federal, state, and local taxes, ensuring compliance and accuracy.

- Tax Filing: ADP handles the preparation and electronic filing of payroll tax returns, saving you valuable time and resources.

- Tax Compliance: The system stays updated on the ever-changing tax laws and regulations, minimizing the risk of penalties.

- W-2 & 1099 Generation: ADP automatically generates W-2s and 1099s, eliminating manual data entry and ensuring accuracy.

- Tax Reporting: Comprehensive tax reports provide insights into payroll tax liabilities and expenses.

- Year-End Tax Preparation: The system streamlines the year-end tax preparation process, ensuring compliance and facilitating a smooth transition.

Employee Self-Service Portal

Employee self-service portals empower employees to manage their payroll information independently, improving efficiency and reducing the burden on HR.

- Access to Pay Stubs: Employees can easily access their pay stubs online at any time.

- Time-Off Requests: Employees can submit time-off requests and track their PTO balance online.

- Personal Information Updates: Employees can update their personal information (address, banking details) through a secure portal.

- Tax Information Updates: Employees can update their W-4 information securely online.

- Communication Tools: Some portals offer communication tools for employees to ask questions or communicate with HR.

- Reduced HR workload: The portal frees up HR staff from handling routine employee payroll inquiries.

Benefits Administration

ADP often integrates benefits administration features with its payroll system, making it a comprehensive HR solution.

- Open Enrollment: Simplifies the open enrollment process by automating employee communication and benefit selection.

- Premium Calculations: Automates premium calculations based on employee elections.

- COBRA Administration: Manages COBRA administration, including premium calculation and notification.

- Direct Deposit of Benefits: Allows for direct deposit of benefit payments.

- Benefits Reporting: Provides reporting capabilities to track employee benefits usage and costs.

- Integration with Payroll: Seamless integration with the payroll system for efficient administration.

Conclusion

ADP payroll offers a robust and comprehensive solution for managing payroll and related HR functions. Its automated features, robust security measures, and compliance capabilities make it an attractive option for businesses of all sizes. While cost can vary, the potential for increased efficiency, reduced errors, and minimized compliance risks often outweigh the investment. Careful consideration of your specific business needs, employee count, and budget is vital when selecting a payroll system, and a consultation with ADP is highly recommended to determine the best fit for your organization. The comprehensive features and scalability make ADP a powerful tool for streamlining HR processes and maximizing operational efficiency.